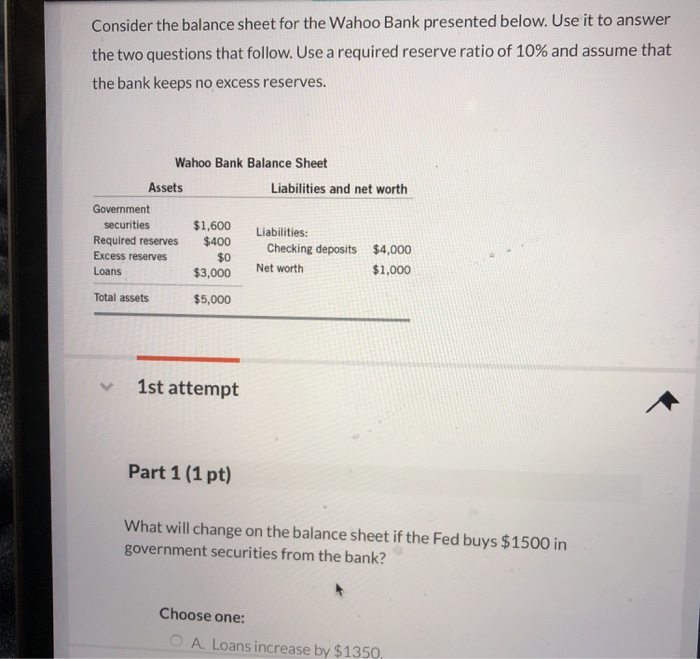

Consider the Balance Sheet for the Wahoo Bank

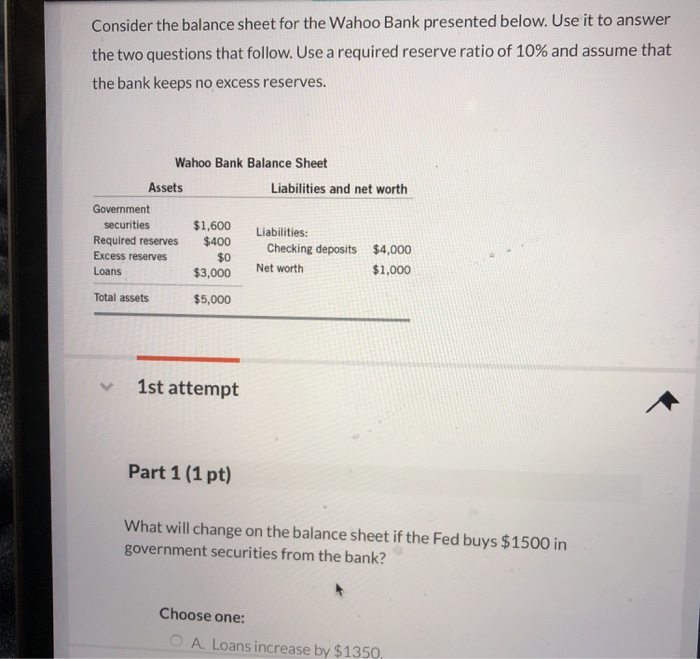

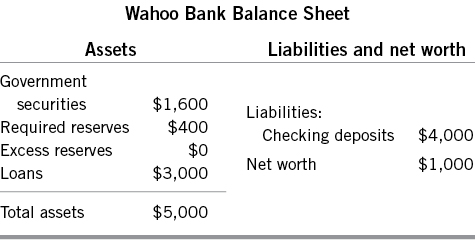

Central bank to. Wahoo Bank Balance Sheet Assets Liabilities government securities 1600 Liabilities.

Solved O Bank As Presented Below Wahoo Bank Balance Sheet Chegg Com

Use a required reserve ratio of 10 and assume that the bank.

. Use it to answer the two questions that follow. Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves. What are its current excess reserves.

Wahoo Bank Balance Sheet Assets Liabilities and net worth Government 1600 Liabilities. Principles Of Macroeconomics ECON 201 ECON 20 1 - Chapter 1 7 Problem Set - Money and the F eder al R eserve. Consider the following balance sheet for the Wahoo Bank.

Use it to answer the two questions that follow. The Fed purchases 1000 worth of government securities from a commercial bank. Consider the following balance sheet for the Wahoo Bank.

25 What will change on the balance sheet if Bennett withdraws 200 from his checking account. Suppose that y ou tak e 150 in curr ency out of your pock et and deposit it in your checking. 16th attempt Part 1 1 pointSee Hint What will change on the balance sheet if Shantee withdraws 200 from her checking account.

Wahoo Bank Balance Sheet Assets Liabilities government securities 1600 Liabilities. Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves. Loans increase by 800.

Consider the balance sheet for the Wahoo Bank as presented here. Consider the balance sheet for the Wahoo Bank presented below. Consider the following balance sheet for the Wahoo Bank.

Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves. Consider the balance sheet for the Wahoo Bank presented below. Keeps no excess reserves.

Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves. May 16 Reuters - New York Federal Reserve President John Williams said on Monday that selling mortgage-backed securities could be an option for the US. 15 hours agoA dds quotes background.

Use it to answer the two questions that follow. 1st attempt Part 1 1 pointSee Hint What will change on the balance sheet if Shantee withdraws 200 from her checking. 3 Consider the balance sheet for the Wahoo bank as presented below.

Solution Part 1 1 point What will change on the balance sheet if the Fed buys 1000 in government securities from the bank. Wahoo Bank Balance Sheet. Assuming a requir ed reserve r atio of 10 wha.

Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves-Outstanding liabilities decrease by 200. Solution Part 1 1 point What will change on the balance sheet if Beth Anne withdraws 200 from her checking account. ECON 201 - Chapter 17 Problem Set.

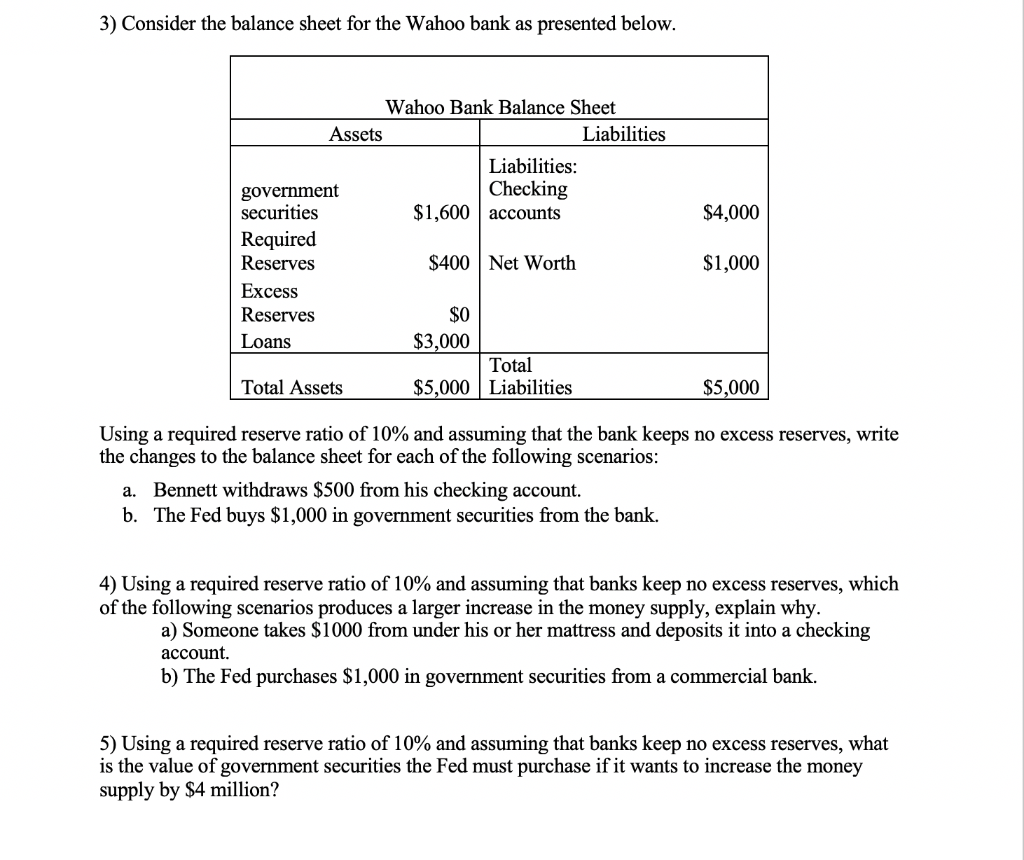

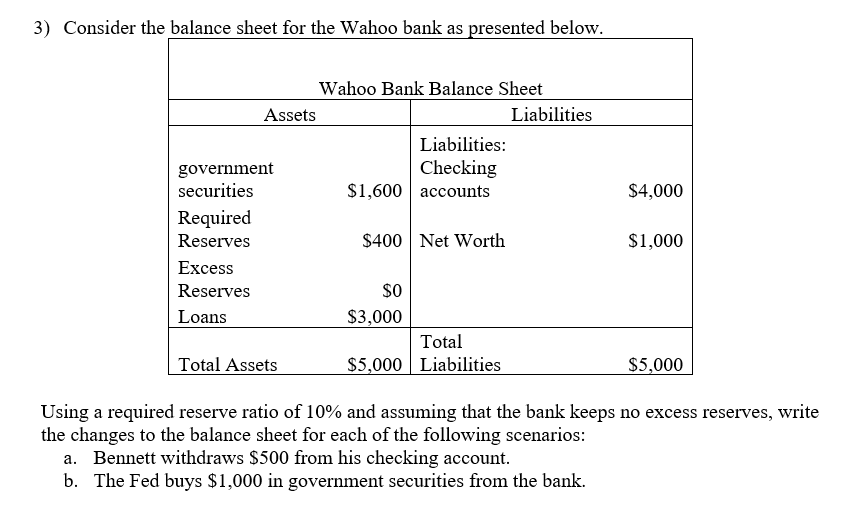

Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves. Checking accounts 4000 Required Reserves 400 Net Worth 1000 Excess Reserves 0 Loans 3000 Total Assets 5000 Total Liabilities 5000 Using a required reserve ratio of 10 and. What will change on the balance sheet if Bennett withdraws 200 from his checking account.

Consider the balance sheet for the Wahoo bank as presented below. Liabilities decrease by 200. Checking accounts 4000 Required Reserves 400 Net Worth 1000 Excess Reserves 0 Loans 3000 Total Assets 5000 Total Liabilities 5000 Using a required reserve ratio of 10 and.

Consider the balance sheet for Wahoo bank as presented below. Consider the balance sheet fro the Wahoo Bank as presented here. Wahoo Bank Balance Sheet Assets Liabilities Government.

What will change on the balance sheet if the Fed buys 800 in government securities from the bank. Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves. What will change on the balance sheet if the Fed buys 800 in government securities from the bank.

Using a required reserve ratio of 10 and assuming that the bank keeps no excess reserves write the changes to the balance sheet for each of the following scenarios. Use it to answer the two questions that follow. Securities Required reserves Excess reserves.

Use it to answer the two questions that follow. Loans increase by 900 B. What will change on the balance sheet if Bennett withdraws 200 from his checking account.

Keeps no excess reserves. ECON 201 - Chapter 17 Problem Set. Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves.

Consider the following balance sheet for the Wahoo Bank. Question2 points Consider the following balance sheet for the Wahoo Bank. What will change on the balance sheet if the Fed buys 800 in.

Outstanding liabilities decrease by 200. Two questions that follow. Consider the balance sheet for the Wahoo Bank as presented here.

Wahoo Bank Balance Sheet. Use it to answer the two questions that follow. Enter zero if it has no excess reserves 25000.

What will change on the balance sheet if the Fed buys 800 in. Use it to answer the two questions that follow. AOutstanding liabilities decrease by 200.

Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves. Use it to answer the two questions that follow. Choose one or more.

Consider the balance sheet for the Wahoo Bank presented below. Use a required reserve ratio of 10 and assume that the bank keeps no excess reserves. May 16 Reuters - New York Federal Reserve Bank President John Williams said on Monday selling mortgage-backed securities could be an option for the central bank to consider down the.

3 Consider the balance sheet for the Wahoo bank as presented below.

3 Consider The Balance Sheet For The Wahoo Bank As Chegg Com

Solved Consider The Following Balance Sheet For The Wahoo Chegg Com

Solved 3 Consider The Balance Sheet For The Wahoo Bank As Chegg Com

Solved Consider The Balance Sheet For The Wahoo Bank Chegg Com

No comments for "Consider the Balance Sheet for the Wahoo Bank"

Post a Comment